Term Life Insurance Q&A

About BeyondQuotes

- Why should I choose BeyondQuotes?

- Which companies do we represent?

- Is BeyondQuotes licensed where I live?

- Is my information confidential?

- Do you only offer rate quotes?

- How do we choose which companies to represent?

Defining Coverage

- How much Term Life Insurance do I need?

- What are "level" policies?

- What should be the term length?

- Is it worth insuring my spouse on my policy?

- Can you explain the difference between Term and Whole Life plans?

- I suffer form a pre-existing condition. Can I still be insured?

Applying for a Policy

- How do I apply for Term Life Insurance?

- How do I find the best value plan for my needs?

- What is the waiting period between applying and coverage?

Alcohol Use, DUI's and Life Insurance: Essential Reading

It’s no sweeping statement to say that most people like a drink. At least 65 percent of us drink regularly. If used sensibly, alcohol can be a relaxant, and as such is a very social drug that is readily available, nationwide.

The fact that it is so easily available makes alcohol even more dangerous. Alcohol accounted for over 76,000 deaths last year alone, and this figure rises with each successive year.

Not surprisingly, alcohol –like tobacco- is considered to be a high risk factor for insurance companies and they like to know to what extent you use it and whether you have had a history of alcohol abuse or not. When applying for either term or whole life insurance, you can count on being asked two questions related to alcohol consumption:

- Do you have a conviction for a DUI charge (Driving Under the Influence of alcohol)?

- How much alcohol do you drink and how regularly?

Your answers to these two questions will affect how much you pay for a policy. An alcoholic person will pay up to four times more than a teetotaler just as tobacco smokers will pay significantly more as a considered risk.

Underwriting for life insurance is more of an art than an applied science, and there is no consensus or consistency among competing policy providers on how to deal with the outcome of either of these two questions, particularly the second one. DUI's on the other hand usually yield similar consequences when applying for a life policy.

What if I have a DUI on record?

Drivers must have a blood alcohol reading of lower than 0.10%, unless they are below the legal age for alcohol consumption, in which case a no-tolerance approach is adopted. After a DUI conviction, drivers will face all manner of problems getting insured for at least five years.

If you have a DUI on your record (unless a significant amount of time has since lapsed) will mean you won't qualify for your preferred rating class and therefore cost you significant amounts of money. If it was recent, or if you have been charged with several DUI's, your premium will cost far more, all other risk factors notwithstanding.

How much is too much*?

Life insurance companies are notorious for cancelling policies for those who have lied about their history, in particular DUI offences, but don't worry! There are some DUI friendly companies, such as GMAC or Progressive. These will offer highly competitive rates, but they will still view your record. It is a myth that there are companies out there that don't.

On the bright side, your DUI won't stand against you indefinitely, but it will make your life difficult (or at least less affordable) for a good few years. Your best option is to watch your drinking, mind your health, wait for a while, then start looking for a good deal on your policy. After enough time has passed, insurance providers will look more favorably upon your circumstances and you can expect to pay less for your premium.

As tempting as it may be to manipulate the truth when applying for life insurance, we recommend that you don't. Be sure to be as accurate as possible on your application about however much you do drink because your policy can easily be (and often is) rescinded if any inaccuracies are discovered (often times after a claim is made).

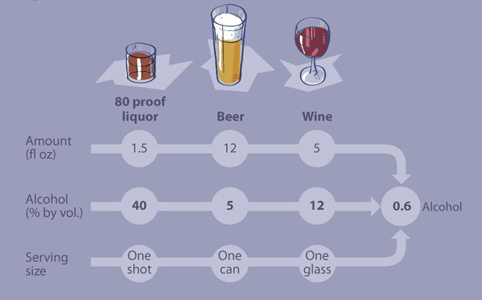

*Bear in mind the legal limit for driving is 0.8% blood alcohol content; little more than a single beer, shot or glass of wine

Will my blood be tested for alcohol when I apply for life insurance?

Not exactly, as alcohol will only stay in your system for around twenty four hours. Excessive alcohol can be detected by testing for elevated liver enzymes which will be part of the paramedical examination.

Before you can be issued a policy (except when it is no-exam life insurance), you will be required to submit a blood sample. Elevated liver enzymes indicate regular drinking habits. upon detection of elevated liver enzymes in your blood, there are a few possible outcomes:

- Your policy application will be overturned

- You will be required to pay a higher premium on your policy

- There will be a delay in your application until the problem can be pinpointed

Modern drinking trends

As you can see from the chart to the left, the United States has a far higher abstention rate that is double that of neighboring Canada, and several times higher than influential EU countries, where alcohol consumption has long been prevalent.

As you can see from the chart to the left, the United States has a far higher abstention rate that is double that of neighboring Canada, and several times higher than influential EU countries, where alcohol consumption has long been prevalent.

The culture of drinking in the US tends to be more relaxed, unlike other countries whereby it is often seen as a necessary accessory to social interaction. This demonstrates a radical change in drinking trends in the past 50 years as public awareness has improved dramatically in the US, with people's wallets being affected by their lifestyle choices as well as their health.

The chart to the right shows that, contrary to general public perception, poorer people drink less than richer people, with almost 60% of lower income women abstaining from drink as compared to fewer than 10% of higher income women who don't.

This is reflected in male drinkers also, with eight times as many lower income men abstaining as compared to higher income men. This can be attributed not only to the high tariffs attached to alcohol and the yearly rise in taxes on drink, but also the fact that people who socialise more tend to visit restaurants and bars on a regular basis.

But I don't drink excessively!

Sure, drinking to excess is associated with shorter life expectancy, but there is no agreement as to what is excessive. Is it one drink a day, or two, or is it six? There is also the point to consider that light drinking has been known to increase life expectancy by a few years and cut down on both heart attacks and stroke. It is for these reasons that insurers use three determining factors when drawing conclusions as to your drinking habits:

- A drinking survey which asks basic questions relating to an individual’s alcohol consumption

- Your motorist’s record, including any DUI’s and any other police complaints

- Your paramedical exam results (blood test, urine sample, etc)

Lastly, two more important points:

- There are over 100 companies in the U.S. that sell life insurance. Most of these are good, solid companies with excellent financial ratings and some don't even require taking a paramedical examination.

Shopping 100 companies obviously is a bit of a chore, (and not recommended) but the point is that you have options. Don't assume that the underwriting from one company to the next will be identical. Rates vary widely.

- If you receive unfavorable results and a high policy rate due to alcohol related reasons, your rate can decrease in time, provided you can furnish sufficient evidence that the issue has been properly addressed.

Moderate drinking, coupled with a good health status will likely have little or no effect with most insurers as you will not have elevated liver enzymes. For those that do practice high alcohol consumption, a little due diligence and abstinence will soon put this to rights and you can still receive favorable rates in time.

Talk to Blake, our resident expert on life insurance with DUI's, life insurance and alcohol, life insurance for smokers, marijuana life insurance and the life insurance paramedical exam.

Blake knows from personal experience just how difficult it can be to deal with insurers after a DUI, what you can do to better your situation, who the best carriers are with whom to insure yourself and many other health related insurance scenarios.

jm 1348 204 112911